BIMCO Shipping Number of the Week: Peak in China's coal demand in sight as renewables jump 12%

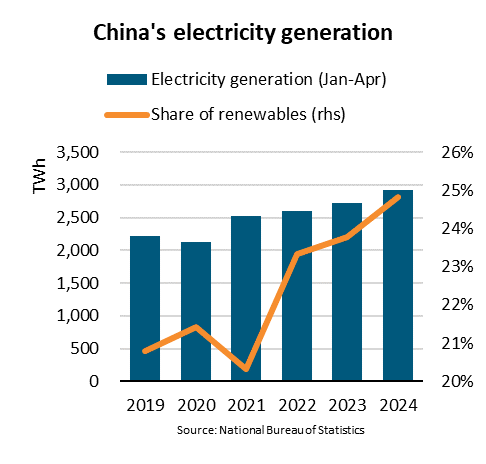

Between January and April 2024, China’s electricity generation from renewables surged 12% y/y, significantly outpacing the 6% growth in generation from fossil fuels. While steam coal shipments to China rose 29% y/y, they are starting to feel the pressure from stronger renewables. Between March and April, the shipments fell 7% y/y as electricity generation from fossil fuels only rose 1% y/y,” says Filipe Gouveia, Shipping Analyst at BIMCO.

So far in 2024, electricity generated from renewables in China accounted for 25% of the country’s electricity production. That is a record for this time of year when renewables are typically weaker.

Compared to 2019, China has more than doubled electricity generation from wind and tripled generation from solar, due to large investments in capacity additions. Investments in new hydro power capacity were less sizeable and generation has stagnated amid two consecutive years of low rainfall.

“Dry bulk shipping has benefitted from weak hydro power and a 4% y/y decrease in Chinese coal mining, due to safety concerns. While hydro power already rose 22% y/y in April, it is uncertain when coal mining could recover. Stronger domestic mining in the second half of 2024 combined with strong electricity generation from renewables would cool steam coal shipments into China,” says Gouveia.

Panamax and supramax ships would be most affected by a potential reduction in steam coal shipments into China. These account for 14% and 9% of all cargoes carried by panamax and supramax ships respectively.

Looking ahead, the International Energy Agency estimates that China will account for almost 60% of the world’s new renewable energy capacity by 2028. This would be enough not only to cover the growth in electricity demand, but also to replace some of the existing electricity generation from coal power plants.

However, managing an increasingly higher share of electricity generation from renewables has its own challenges. China’s electricity grid is already experiencing bottlenecks for new solar power, due to difficulty in storing excess production during the hours of stronger sunlight. Consequently, new solar installations fell to a 16-month low in March.

“The medium-term outlook for coal shipments rests in the Chinese government’s hands. To successfully continue to shift towards renewable energy, they must increase investment in China’s electricity grid and improve energy storage. If these investments are successful, we may soon see peak steam coal demand in China and a gradual decline in shipments,” says Gouveia.

Source: BIMCO