China’s Shipowners Outpace Scrapyards in Frenzied Rush for Capesize Vessels!

In recent months, Chinese shipping companies have dominated the secondhand Capesize bulk carrier market, purchasing older vessels at a fast pace to expand their fleets. This aggressive buying spree has caught the attention of the maritime industry as shipowners are even offering premiums to outbid scrapyards!

**Scrapping Plans Reversed**

In a remarkable deal, a 25-year-old Capesize vessel, *Oriental Navigator*, originally destined for scrapping, was sold for $12 million to a Chinese buyer, surpassing scrap value by $1.8 million. This bold purchase is just one example of China’s willingness to invest in aging ships, defying market expectations.

**High Demand for Newcastlemax Vessels**

China's buying frenzy extends beyond Capesize ships. Recent reports reveal that Chinese interests acquired two Newcastlemax bulkers, *Mineral Cloudbreak* and *Mineral Charlie*, for over $38 million each, both built in 2012 and equipped with modern ballast water treatment systems.

**Major Players Expanding Fleets**

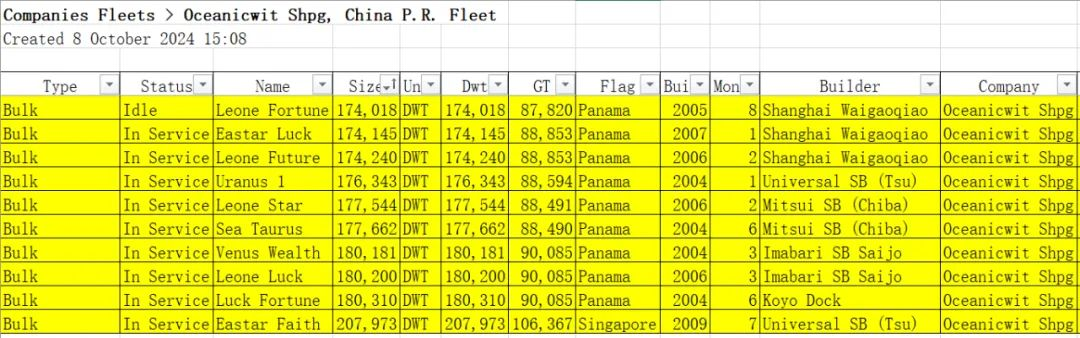

Fujian-based Haitong Development has also made waves, purchasing two Capesize vessels in September, including the *Azure Ocean* for $24.6 million. Similarly, Oceanic Wit, a Chinese shipowner, has swiftly expanded its Capesize fleet to 10 vessels, acquiring several older ships from Greek sellers.

**The Sellers' Perspective**

For sellers, Chinese buyers have become prime partners. A Dubai-based company, Lila Global, offloaded at least four Capesize vessels to Chinese buyers in recent months, further solidifying China’s position as a key player in the secondhand ship market.

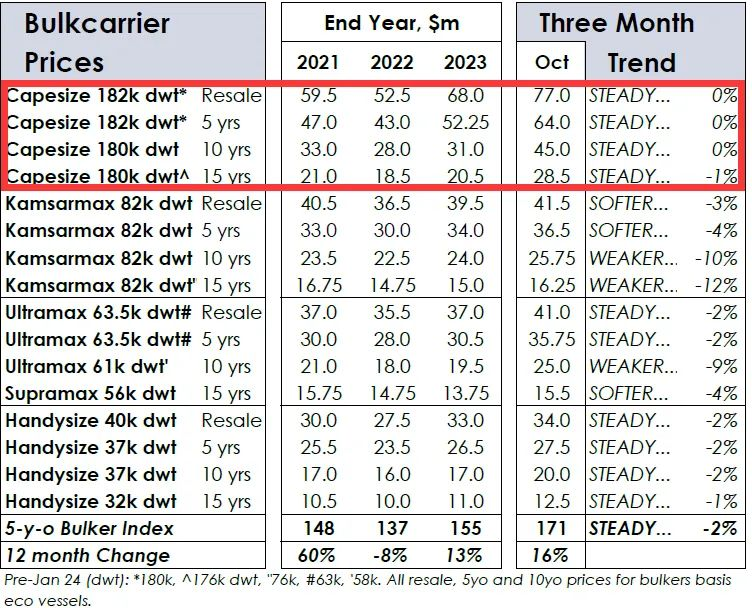

**Rising Prices in a Tight Market**

The surge in demand has driven up prices, with Capesize vessels seeing substantial price hikes earlier this year. For instance, the price of a 10-year-old 180K DWT Capesize ship surged by $14 million in the first half of 2024, a 45% increase compared to late 2023.

As global shipyards remain fully booked until 2027, the supply of new vessels is limited, driving shipowners to secure secondhand ships to capitalize on the rising freight rates and market opportunities.

China’s shipowners are clearly playing the long game, rapidly expanding their fleets while seizing every available opportunity in a booming secondhand market.

Source:Xinde Marine News