Experts forecast at least two more US rate rises to quell inflation. Meanwhile, China is cutting benchmark lending rates to stimulate its economic growth. The EU needs to catch up to America, from technology to energy to capital markets and universities, and the gap is growing. The US secretary of state’s visit to China hopes to ease the tension between countries. Developing countries have hit the financial rocks due to debt pressing. For shipping, in 2023, the shipyards in hand orders are getting reduced due to new building delivery over contract tonnage winning to shipyards.

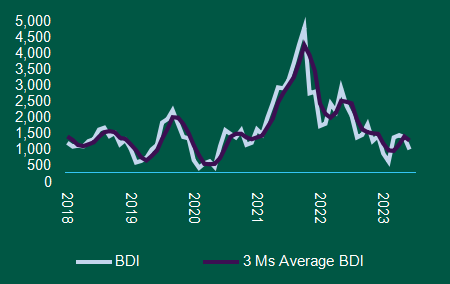

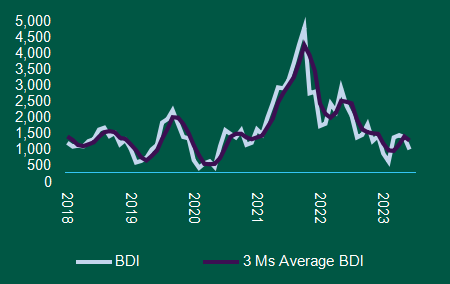

Bulk Carrier:

Argentina’s main grains port is seeing the lowest number of trucks with soy and corn in at least 22 years. When the charter market is low, the asset for dry remains high. For zero carbon emissions by 2050. (MOL) is ordering an LNG-fuelled 94,900 dwt bulk carrier at Oshima Shipbuilding. Ocean Yield has signed up for eight ammonia-ready newcastlemax bulk carriers. Arriva Shipping has ordered an 8,500 dwt battery hybrid dry cargo vessel in China.

Tanker:

As the charter market is under correction, sales and purchase activity in the tanker sector is slowing down. But confidence in the sector is set for an extended boom period. Some owners have taken advantage of solid tanker charter rates and attractive long-term employment. After extreme lows of the tanker order book, the new order is slowly going up, but the sector is going to enjoy lengthy good earnings.

Containership:

The charter markets saw a big drop in long-term rates recently. Containerships are moving at all-time low speeds to cope with the over-supplied tonnage. Maersk plans to retrofit one of its ships to methanol dual-fuel. Rich container owner, MSC, is looking to buy out Wilson Sons, a well-known port and maritime logistics firm with operations across Latin America’s largest country. X-Press Feeders ordered six methanol dual-fuel containerships with delivery in 2025.

The LNG spot charter market seems to have touched the bottom and is slowly moving up. Qatar has signed its second major LNG supply deal with China in less than a year. Knutsen LNG carrier is looking for an LNG lifecycle assessment of environmental, future regulations, and sustainability impact for an LNG ship’s 40 years of life. Golar LNG has confirmed buying the 2004- built LNG carrier for conversion to a floating liquefied natural gas (FLNG) unit.

Offshore:

The offshore charter market remains at a high level. Singapore’s Crystal Offshore plans to build an offshore rig and vessel repair base in Abu Dhabi. Allseas gets more work on German North Sea wind converter platforms. Odfjell Drilling secured more Norwegian Sea work for the CIMC semisub. MOL and Toyo teamed up to form an offshore wind joint venture. Kim Heng signed MoU for the development of South Korean offshore wind projects.

Disclaimer

The above product summary provides a general overview of the terms and conditions of the insurance policy. It does not necessarily address every aspect of the policy terms. It is not the intended to be, and should not be, used to replace specific advice related to individual situation and this should not been seen as legal, accounting or tax advice. The coverage is subject to full terms, conditions and exclusions of the policy.

The views and opinions expressed are those of the author and do not reflect the official position of Oneglobal. The company and its employees hold no responsibility for errors of fact, market changes and/or any losses incurred as a result of the content obtained in this document. Any forecasts and/or trends reported are based on the author’s assumption which may vary from actual situation due to volatile changes. It does not warrant its completeness or accuracy and should not be relied upon. Users are recommended to exercise judgement and discretion while using this information.

Data Resource: FT, Clarksons, Splash 247, Xinde, Hellenic Shipping News