Oneglobal shipping report 2023 July

Economy:

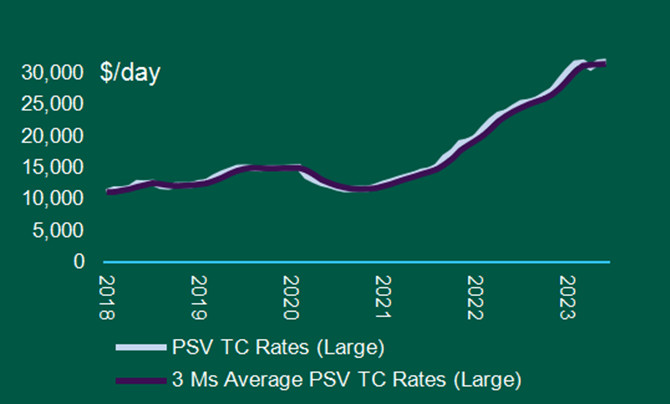

The offshore charter market has reached its highest level since 2014. UK Octopus Energy is to invest $20bn through its generation unit in offshore wind by 2030. Copenhagen Infrastructure Partners (CIP) reached its target fund size of €12bn, which would make it the world’s largest greenfield renewable energy fund. BW Offshore has sold another African- based FPSO vessel. The Australian Government is looking to help decarbonize the economy with year-round clean energy generation.

Disclaimer

The above product summary provides a general overview of the terms and conditions of the insurance policy. It does not necessarily address every aspect of the policy terms. It is not the intended to be, and should not be, used to replace specific advice related to individual situation and this should not been seen as legal, accounting or tax advice. The coverage is subject to full terms, conditions and exclusions of the policy.

The views and opinions expressed are those of the author and do not reflect the official position of Oneglobal. The company and its employees hold no responsibility for errors of fact, market changes and/or any losses incurred as a result of the content obtained in this document. Any forecasts and/or trends reported are based on the author’s assumption which may vary from actual situation due to volatile changes. It does not warrant its completeness or accuracy and should not be relied upon. Users are recommended to exercise judgement and discretion while using this information.

Data Resource: FT, Clarksons, Splash 247, Xinde, Hellenic Shipping News