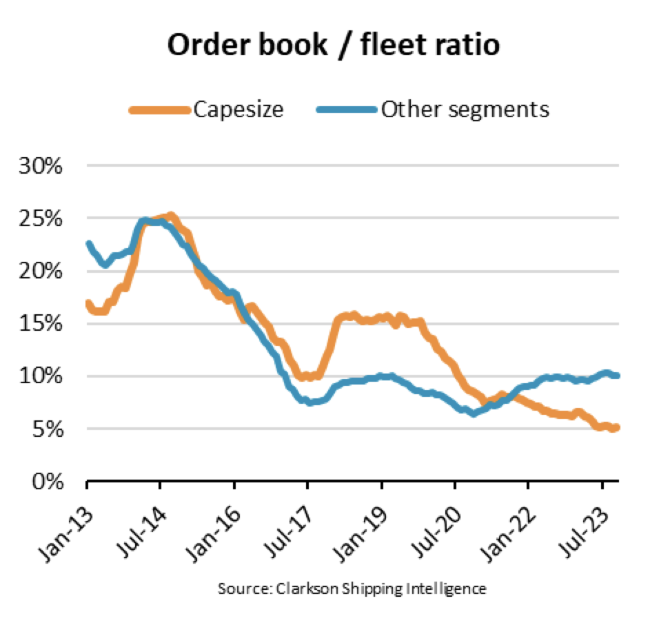

Capesize order book slips to 5% of fleet as contracting falls

“At the start of October, the capesize order book was at 20 million DWT, a mere 5% of the capesize fleet. The contracting of newbuild capesize ships has gradually decreased since its peak in 2013 and only 5 million DWT were contracted so far in 2023, down 4% y/y. Low freight rates paired with a young fleet are keeping the order book small,”says Filipe Gouveia, Shipping Analyst at BIMCO.

Contracting of newbuild ships typically

increases following periods of high freight rates. For capesizes, freight rates

depend heavily on China, as 63% of their cargoes have China as their

destination. Capesize ships are the largest in the dry bulk fleet and transport

most of the world’s iron ore.

2021 was the most recent year when freight rates

surged, causing newbuilding contracting to reach 17 million DWT. However, in

2022 contracting fell 52% as rates slipped due to Covid lockdowns and weaker

Chinese demand. In the first three quarters of 2023, freight rates and

contracting remained low, as China’s economic recovery was

weaker than foreseen, and the real estate crisis remained unresolved.

“Capesize deliveries are

estimated to reach 11 million DWT in 2023, 37% below the 5-year average, and to

further decrease to 7 million DWT in both 2024 and 2025. This low fleet growth

could offer some support to capesize freight rates over the short- to

medium-term and as result support a recovery in contracting,” says Gouveia.

On top of the low freight rates, the lower need

for immediate fleet renewal among capesizes may also explain the smaller

orderbook. The average capesize ship is two years younger than the average bulk

carrier and only 15% of capesize ships, or 54 million DWT, are older than 14

years.

Decarbonisation is an important force driving

fleet renewal. While shipowners may opt to retrofit younger ships, they may

choose to replace older inefficient ships. For capesizes, the transition to

alternative fuels may be easier than for smaller segments, since they operate

in a reduced number of trade lanes. This makes it easier to ensure the supply

of the necessary fuels in relevant ports.

“Capesizes could emerge as

frontrunners in the adoption of alternative fuels among bulk carriers, even

though they are the youngest fleet. 55% of their order book is for ships which

are either capable or ready to run on LNG, methanol or ammonia, a much higher

share than the 17% average for the entire dry bulk order book,” says Gouveia.

Source: Xinde Marine News