POSITION:Home > NEWS > Media Coverage > Body

BIMCO Shipping Number of the Week: Crude tanker newbuild contracting jumps 490% as VLCC orders gain pace

Posttime:2024-03-08 09:09:00

Hits:227

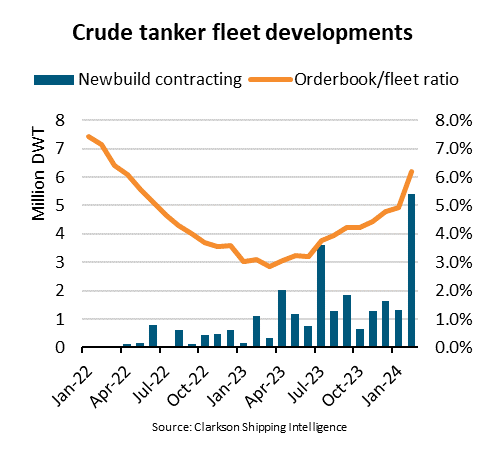

“In the first two months of 2024, crude tanker newbuild contracting surged to 7.4 m DWT, a 490% leap y/y, due to a rise in orders for very large crude carriers – VLCCs. A notable 19 VLCCs were ordered, already surpassing the number of orders for this ship type during all of 2023,” says Filipe Gouveia, Shipping Analyst at BIMCO.

Since the start of the war in Ukraine, freight rates for crude tankers have spiked and stayed strong during the first two months of 2024. The Baltic Exchange Dirty Tanker Index on average increased marginally compared to the first two months of 2023, delivering the highest average for January and February since 2006. VLCCs saw the strongest start to the year.

In March 2023, the crude tanker orderbook accounted for only 3.3% of the crude tanker fleet, the lowest point since at least 1996. However, during 2023, orders for suezmax ships rapidly increased and orders for VLCCs have followed. By February 2024, the crude tanker orderbook to fleet ratio had risen to 6.2%. Despite the high rate of contracting, the orderbook to fleet ratio for VLCCs remained at just 4.3%

“As stated in our recent Tanker Shipping Market Overview and Outlook report, the near-term outlook seems positive for crude tankers. The supply/demand balance could tighten due to low fleet growth and longer sailing distances. The outlook seems especially favourable for VLCC ships and could support freight rates in the segment,” says Gouveia.

VLCC, the largest crude tankers, typically transport crude oil from the Middle East and the Americas to Asia. In the coming years, we expect more oil to come from the Americas and oil demand to shift increasingly towards Asia. This would not only boost sailing distances, but also benefit VLCC ships especially, since they already dominate these trade lanes.

70% of the ship capacity contracted in 2023 and all the ships contracted so far in 2024 will be delivered between 2026 and the end of 2027. As such, freight rates will be supported by low fleet growth until then. From 2026 onwards, the risk of oversupply seems small as of now. Even though contracting increased, the current orderbook is still small by historical standards. Nonetheless, more ships could still be ordered for delivery in 2026 and 2027.

“Despite the positive medium-term outlook, the International Energy Agency currently predicts that global oil demand could peak by 2030. Nonetheless, the restructuring of global trade lanes since Russia's invasion of Ukraine has increased demand for ships and there is a need to renew at least part of the aging fleet. It is therefore very likely that we will see a further increase in the orderbook during the rest of the year,” says Gouveia.

Source:BIMCO